View / Download June/July 2022 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

For years prior to 2018, divorce-related professional fees were deductible as miscellaneous itemized deductions if they were incurred (1) for tax advice or (2) the procurement of taxable spousal support.

However, the 2017 Tax Cuts and Jobs Act eliminated miscellaneous itemized deductions and, correspondingly, the deduction of otherwise qualifying divorce-related professional fees.

But, as under prior law, some divorce-related professional fees may be added to the tax basis of assets received or retained in a divorce, hence reducing taxable gain on disposition.

This was the holding in Gilmore v United States, 245 F Supp 383 (ND Cal 1965), which involved the protection of a business interest from claims of the nonowner spouse.

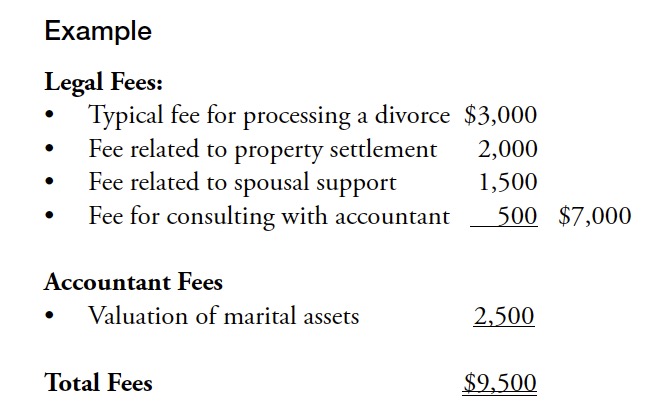

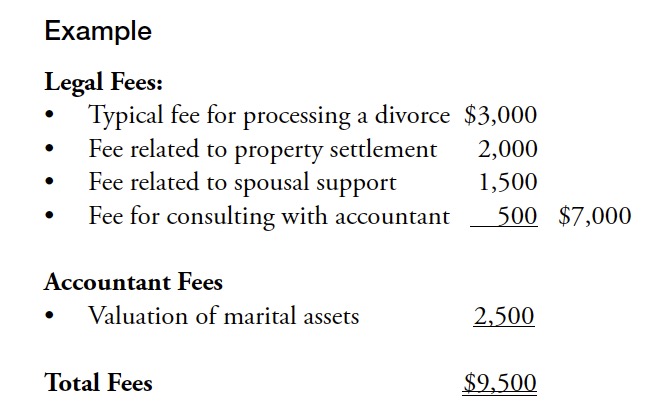

The portion of the fees that may be capitalized as additional tax basis is that which is attributable to services related to the protection, preservation, or acquisition of the business or investment property. In general, this portion is that part of the fees associated with the property settlement. The example at the end illustrates the determination of the addition-to basis component of legal and accounting fees.

It should be noted that for spouses who retain no assets, fees allocable to property settlement may nonetheless be an addition to the basis of marital assets transferred to the other spouse (who takes a carryover tax basis, increased by the fees, under IRC 1041).

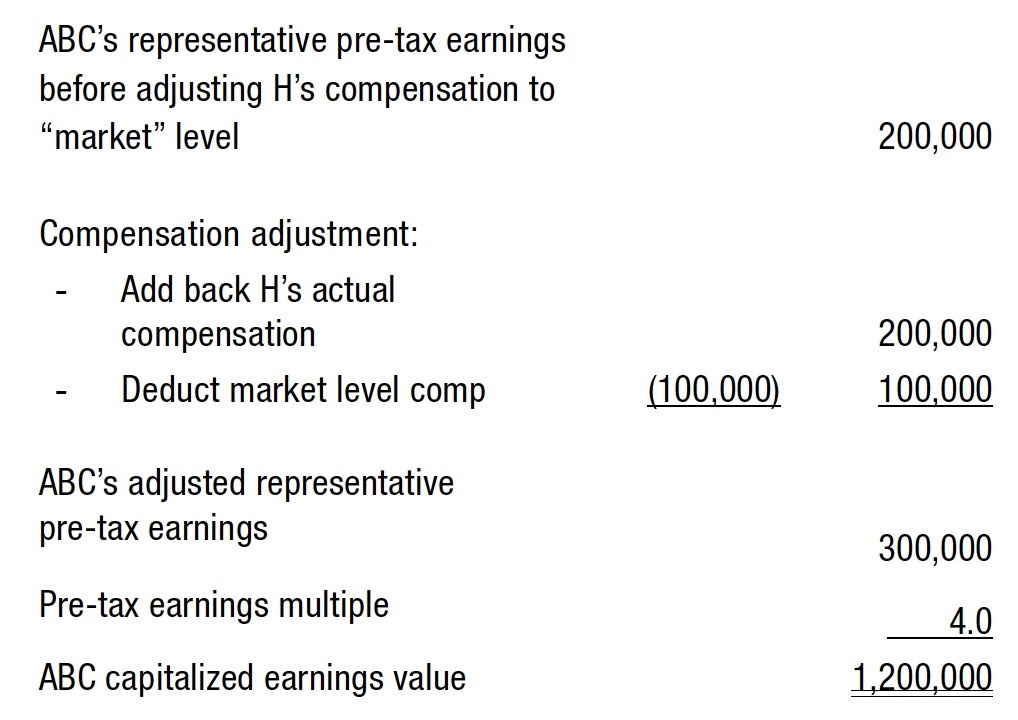

Whenever there is a rational basis for allocating a fee, or part of a fee, to a particular asset (e.g., a fee for the valuation of a closely held business), that fee should be specifically allocated to the asset it relates to. Other fees that qualify as additions to a basis for a spouse are allocated among assets awarded

to that spouse pro rata their respective FMVs.

The IRS accepted this method of allocation in Spector v Commissioner, 71 TC 1017 (1979), rev’d and remanded on other grounds, 641 F2d 376, cert denied, 454 US 868 (1981); Treas Reg 1.212-1(k). The portion of the fees. However, the IRS maintained that a ratable portion of the fees had to be allocated to cash (which can never have a basis in excess of its face value) as well as to noncash properties. The Tax Court upheld the IRS position, thus eliminating any tax benefit of the fees allocated to the cash. The same applies to retirement benefits. That is, a portion of fees should be allocated to them but cannot increase their tax basis.

Similarly, with the large exclusion of gain available on most sales of principal residences, the allocation of fees thereto will often provide no tax saving benefit.

Contemporaneous Documentation

Whenever a divorce-related professional fee qualifies as an addition to basis, it is important that the tax benefit portion of the fee be specifically allocated to the related work. McDonald v Commissioner, 52 TC 82 (1969); Hall v United States, 78-1 US Tax Cas (CCH) ¶9126 (Cl Ct 1977), adopted, 78-1 US Tax Cas (CCH) ¶9420 (Cl Ct 1978). Rev Rul 72-545 stressed the importance of clearly establishing “a reasonable basis for allocating to tax counsel a portion of the legal fees incurred in connection with the divorce proceedings.” Some attorneys issue separate invoices for tax benefit work. Regardless of how such work is invoiced, it should be described in appropriate detail. Moreover, it is clearly preferable that the actual detail be provided when an invoice is submitted, rather than a year or more later when a client is being examined by the IRS concerning the estimated deductible portion of the fee.

Practice Pointer

Counsel should, at the close of every case, determine whether any of the professional fees incurred qualify as additions to tax bases of assets his or her client received. Also at that time—not later—counsel should include the results of the determination in a letter to the client and suggest it

be given to the client’s tax advisor. Not only is this a moneysaving service to the client, it is in counsel’s “enlightened self interest,”

since it will often reduce the client’s cost of paying the attorney fees.

Allocation of Fees to Tax Basis

- $2,000 property settlement legal fee – Allocable to property awarded to client pro-rata to their respective values.

- $500 legal fee consulting with valuation expert – Allocable to assets valued by the expert, pro-rata to their respective values.

- $2,500 accountant’s fee – Allocable to assets valued by the accountant pro-rata to their respective values.

It should be noted that allocating fees as described above will provide minimal benefit in the many cases where the assets consist, in the main, of retirement benefits and equity in a home. However, it is important to be aware of the potential for benefit in every case and then take advantage where there is the opportunity to do so.

The author once worked on behalf of a woman who had inherited a large stock portfolio. Her divorce attorney billed her $50,000 – largely to protect her inheritance. Post-divorce, she married a stockbroker who promptly sold and reinvested the entire portfolio. $45,000 of the $50,000 divorce lawyer fee was added to the basis of the stock sold, hence reducing the taxable gain by same amount and saving substantial federal and state income taxes.

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

Download the PDF file below… “Divorce-Related Professional Fees May Be Added to the Tax Basis of Property Received or Retained in a Divorce”

View / Download June/July 2022 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)

Read More “Jun/Jul 2022 : Divorce-Related Professional Fees May Be Added to the Tax Basis of Property Received or Retained in a Divorce”