View / Download February 2020 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

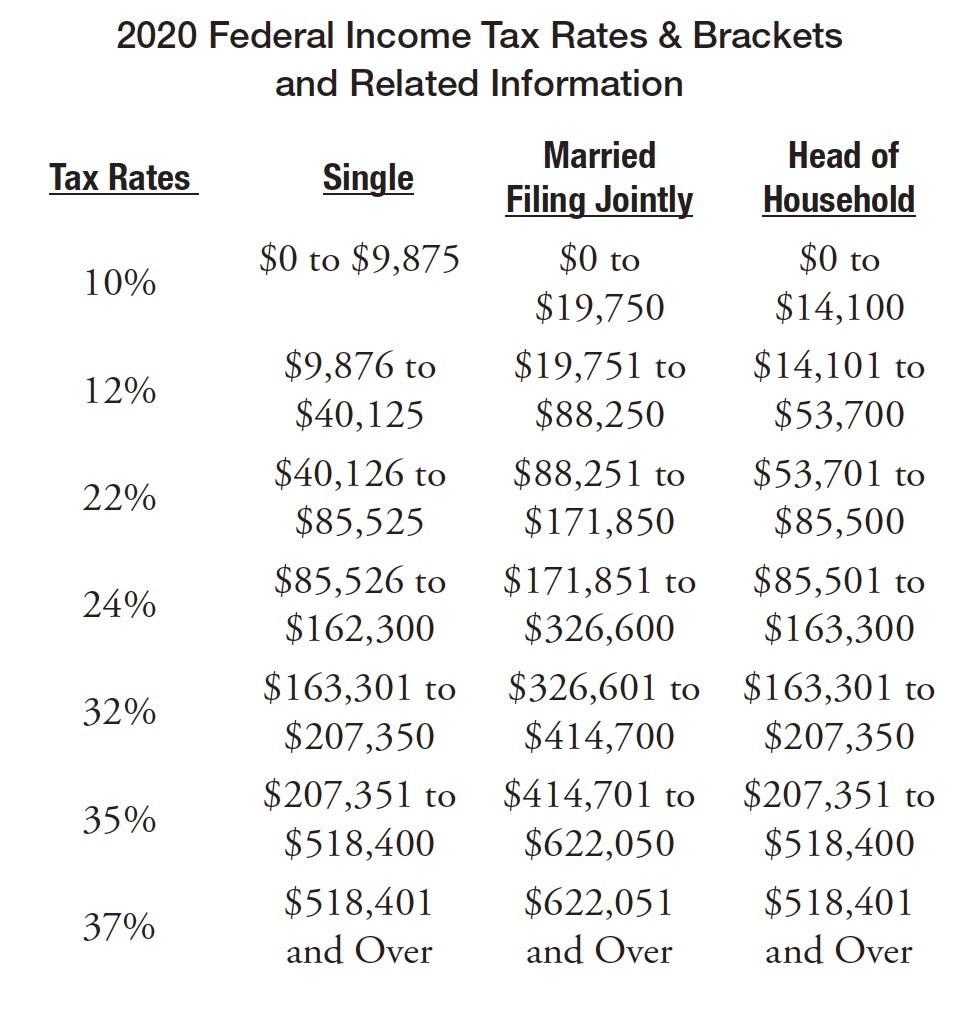

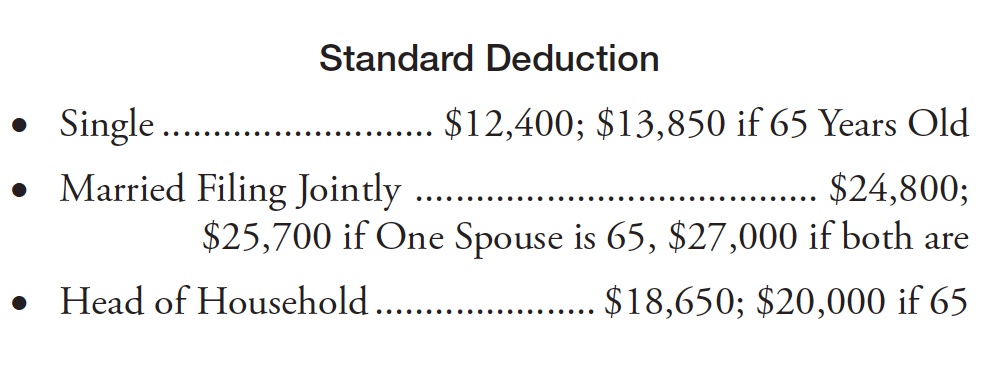

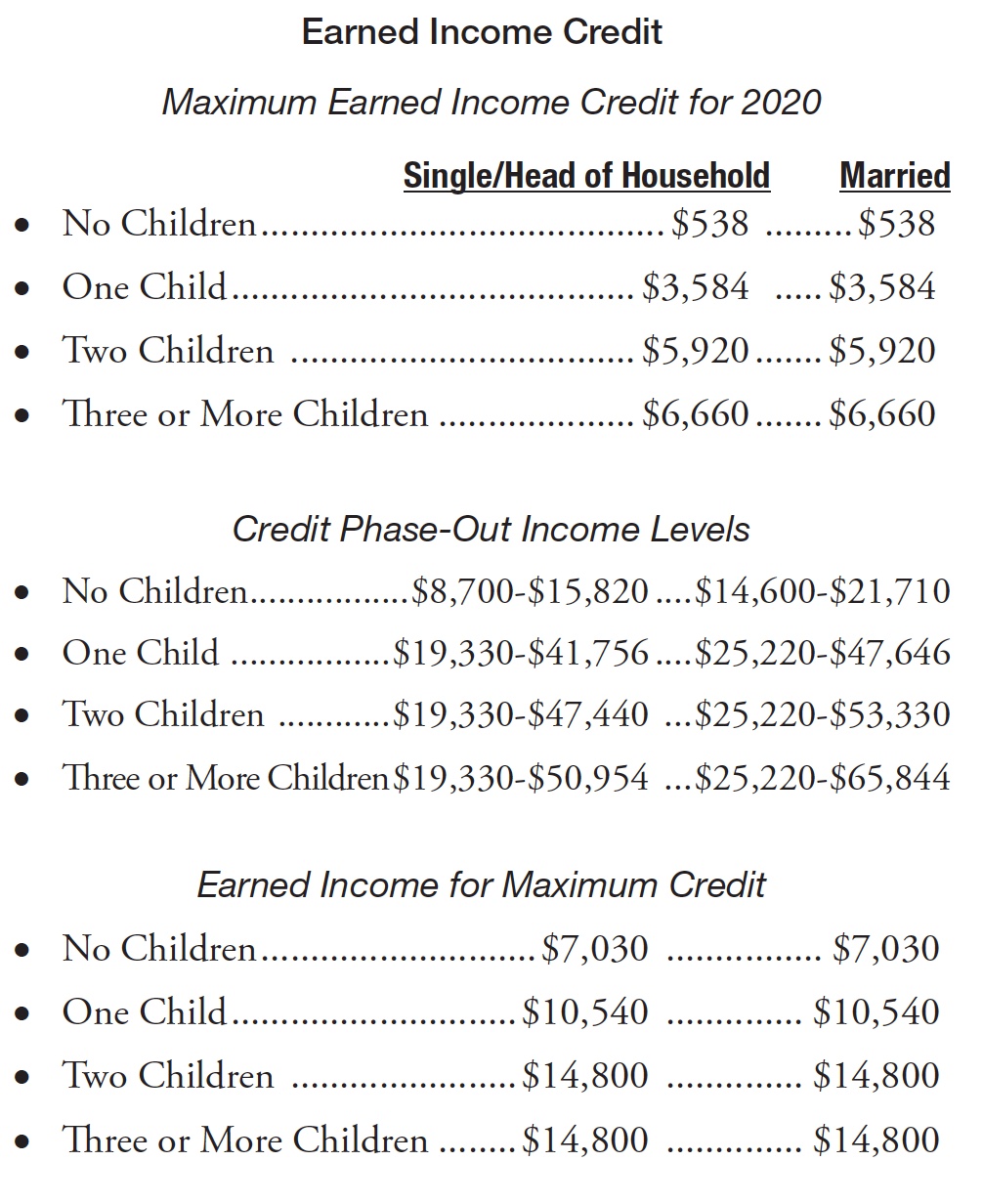

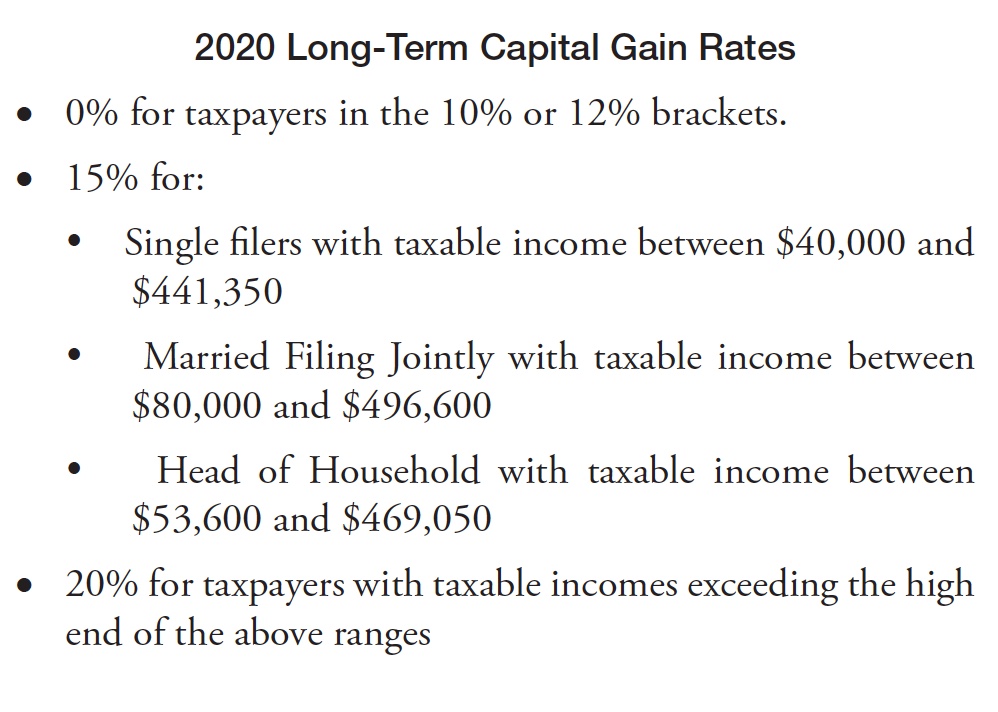

Federal Income Tax

The following are inflation adjusted tax rates and the standard deduction for 2020 as announced by the IRS (IR-

2019-180).

Tax Rate

The Michigan income tax rate remains unchanged at a 4.25% flat rate.

Personal Exemption

The number of personal exemptions a Michigan taxpayer could claim had previously been tied to the number claimed for federal tax purposes. With the elimination of federal tax personal exemptions, Michigan enacted Senate Bill 748 (Bill), signed by Governor Snyder on February 28, 2018.

Under the Bill, the reference to federal exemptions is removed and the Michigan personal exemption deduction is increased from the $4,000 2017 allowance as follows:

- 2018 – $4,050

- 2019 – $4,400

- 2020 – $4,750

- 2021 – $4,900

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

View / Download February 2020 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)