View / Download December 2022 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

As the year-end approaches, there are frequently choices to make involving taxes, such as when to take a taxable distribution from an IRA or retirement plan interest, perhaps obtained via a QDRO.

Also, an individual’s federal income tax rate may be significant in determining after-tax income available for spousal &/or child support.

The IRS annually adjusts tax brackets for inflation to prevent “bracket creep” – that is, an individual pays tax on some income in a higher tax bracket simply because inflationary increases in his/her income. Because of the relatively high rate of inflation this year, the tax bracket adjustments are higher than usual.

Thus, working people with the same income will have higher take-home pay in 2023 and, hence, more disposable income.

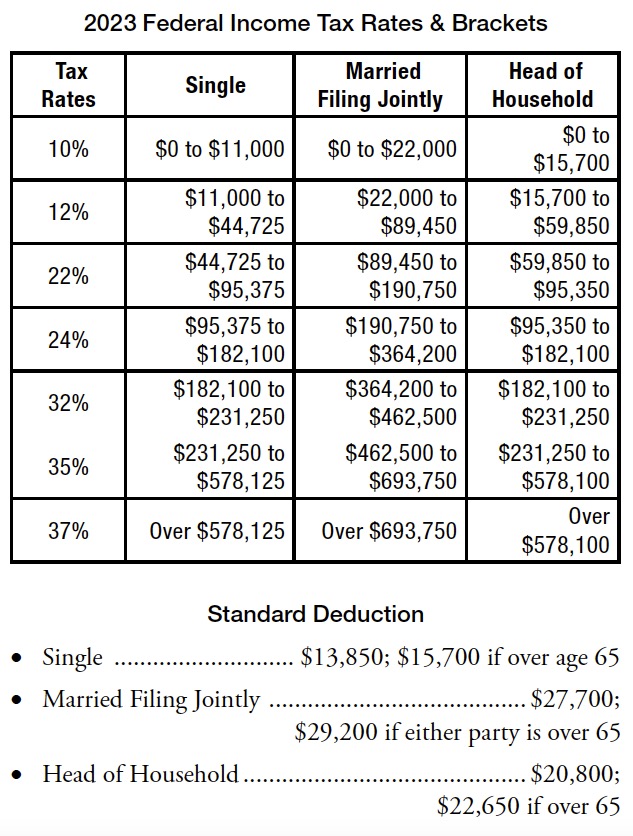

To assist with year-end tax planning, the 2023 brackets are presented at right.

Federal Income Tax

The following are inflation adjusted tax rates and standard deductions for 2023 as announced by the IRS (IR-2022-182, October 18, 2022).

Personal Exemption

There is no federal income tax personal exemption. It was eliminated by the Tax Cuts & Jobs Act. of 2018.

2021 Long-Term Capital Gain Rates

- 0% for taxpayers in the 10% or 12% brackets.

- 15% for:

- Single filers with taxable income between $44,625 and $492,300

- Married Filing Jointly with taxable income between $89,259 and $553,850

- Head of Household with taxable income between $59,750 and $523,050

- 20% for taxpayers with taxable incomes exceeding the high end of the above ranges

Child Tax Credit

The Child Tax Credit remains $2,000 for qualifying children. A qualifying child is, in general, a child of the taxpayer who resides with the taxpayer for more than half of the year.

Michigan Income Tax

Tax Rate

The Michigan income tax rate remains unchanged at a 4.25% flat rate.

Personal Exemption

The number of personal exemptions a Michigan taxpayer could claim had previously been tied to the number claimed for federal tax purposes. With the elimination of federal tax personal exemptions, Michigan enacted Senate Bill 748 (Bill), signed by Governor Snyder on February 28, 2018.

Under the Bill, the reference to federal exemptions is removed. The Michigan personal exemption deduction for 2022 is $5,000.

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

View / Download December 2022 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)