View / Download February 2023 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

At this time of year, parties who have recently divorced or are in the process of obtaining a divorce must consider how to file their federal income tax return.

The following present the options available, the rules regarding filing status, and planning opportunities.

Options

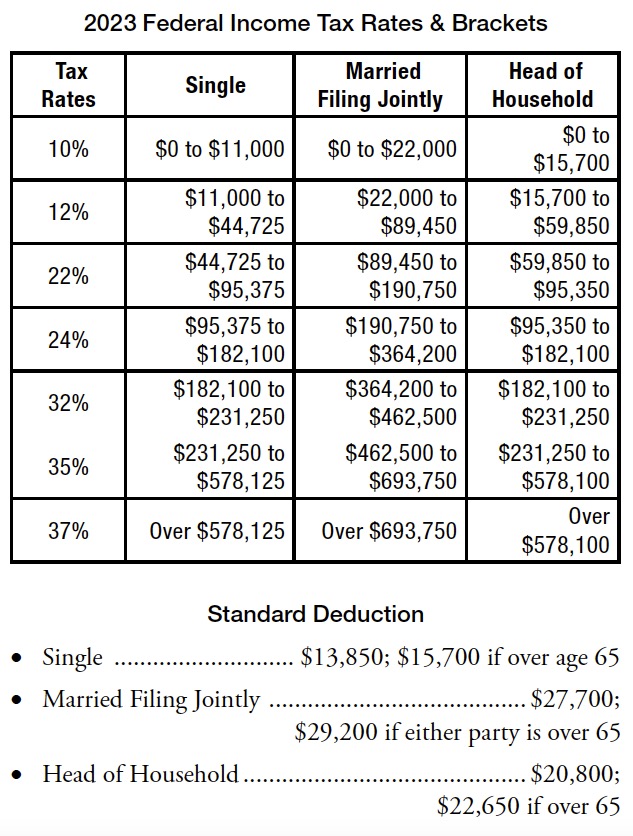

The filing options are, essentially:

- Joint tax return at the lowest rates.

- Single tax return with higher rates

- Head of Household with rates between the joint and single rates.

- Married filing separately with the highest rates.

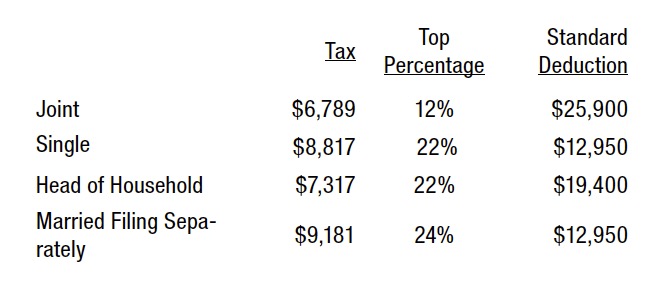

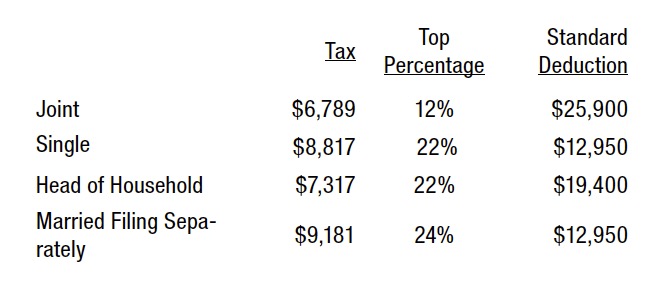

For example, the tax on $60,000 taxable income in 2022 and the 2022 standard deduction are as follows:

As this shows, the difference between filing jointly and married filing separately is considerable, particularly at higher income levels. But, even at lower levels, the difference in the standard deduction is significant – a 100% higher joint vs. married filing separately.

As this shows, the difference between filing jointly and married filing separately is considerable, particularly at higher income levels. But, even at lower levels, the difference in the standard deduction is significant – a 100% higher joint vs. married filing separately.

Rules

Parties Divorced in Prior Year

How parties may file is determined by whether they were divorced as of December 31 of the prior year. If they were, the parties cannot file a joint return. Rather, they must file as single taxpayers or, if certain qualifications are met, as head of household.

Parties Not Divorced in Prior Year

If parties were still married at December 31, they may file a joint return for the prior year or may file married filing separate returns – at the steepest rates.

However, one (or possibly both) of them may qualify as married head of household as follows:

- Must provide more than half the cost of maintaining a household;

- Have a qualifying child or dependent who lived in the household more than six months of the year; and,

- At the end of the year must be considered unmarried.

“Considered unmarried” though still legally married requires that a party satisfy the head of household requirements and, in addition, that the other spouse did not live in the home during the last six months of the year.

Planning Considerations

Joint or Separate Return?

If a divorce process is in the latter part of a calendar year, it is generally advisable to “run the numbers” both ways – that is, joint filing and separate return filing – especially if one spouse may qualify as head of household – to determine which way yields the lower overall tax.

In general, joint filing will typically result in lower overall tax if one party has significantly more income than the other. Because of this, it is not uncommon in such cases to finalize the divorce in all respects but to postpone filing the judgment until early January so a joint return can be filed.

However, there are instances where one party suspects the other of fraudulent or highly aggressive tax positions and does not want to be subject to the potential “joint and several” liability that applies to joint return filers. Further, awareness of such tax positions may preclude a claim of “innocent spouse.”

Thus, it may be advisable for the suspecting party to consider filing a separate return.

Or, if a joint return is filed, for him or her to secure a “hold harmless” provision regarding any tax deficiencies, penalties, and professional fees attributable to fraudulent or highly aggressive filing positions taken by the other spouse.

Estimated Tax Payments; Tax Refunds & Overpayments

Another important consideration for a divorce related tax return filer is the area of estimated tax payments; tax refunds & overpayments. Below is the August 2022 column regarding this matter.

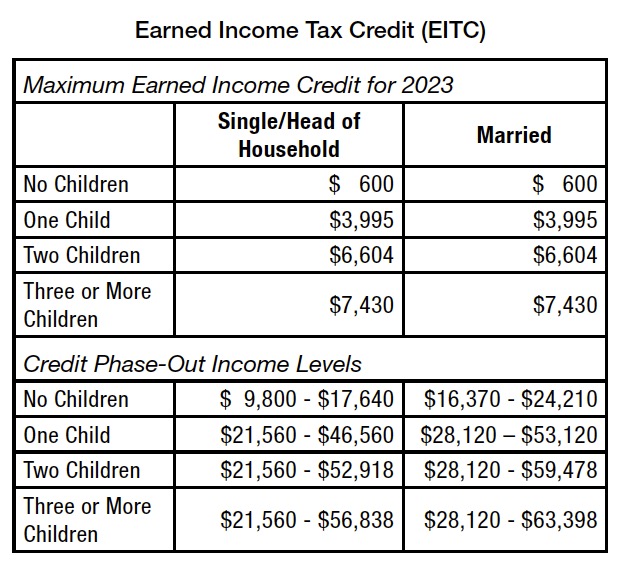

Estimated tax payments made – and/or taxes withheld – during the year of divorce are generally a marital asset. Tax refunds or, overpayments applied to next year’s tax, attributable to tax payments made during marriage are also a marital asset.

And, it may cut the other way – that is, estimated tax payments and/or taxes withheld may be less than the actual tax on marital income received and shared during the year of divorce.

In this regard, note the following:

- Separate Returns for Year of Divorce – Whether divorcing parties can file a joint return or must file separate returns depends on their marital status as of December 31. If divorced as of that date, they must file separate returns for their respective separate incomes and deductions.

- Estimated Payments Automatically Are Credited to the Husband – Since the husband’s social security number (SSN) is generally listed first on joint estimated payment vouchers (Form 1040ES) made during marriage, such payments will automatically be credited to him unless there is a written alternative provision agreed on by the parties.

The same applies to tax overpayments on the parties’ last joint return applied to the following year’s tax.

- Estimated Tax Payments and Tax Withheld During Marriage Are Marital Funds – Absent unusual circumstances, estimated tax payments and tax withheld during marriage are made with marital money – essentially half by each party.

The above matters are often not addressed in divorce settlements. The following presents (1) observations on such tax payments and (2) applicable tax law.

Tax Payments Made During the Year of Divorce

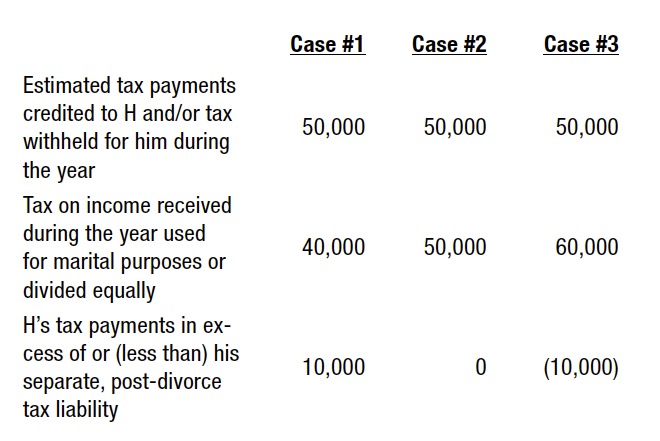

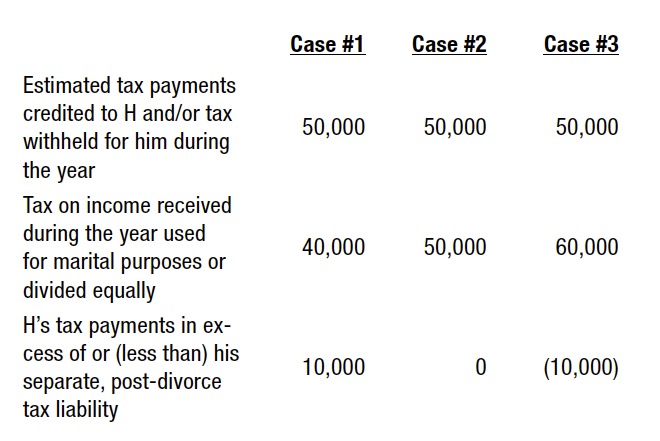

Example – Assume the following alternative facts for joint estimated tax payments made by – and/or withheld on behalf of H – during the year of a divorce for which the judgment is entered on December 30.

So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.

So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.

In Case #3, it is H’s attorney who needs to (1) identify that H will pay $10,000 of his own funds on income equally shared with W and (2) make an offsetting adjustment. When paying the $10,000, H will, in effect, be paying both his and W’s $5,000 shares of the tax on marital income.

Agreement to Apportion Joint Estimated Tax Payments

IRS Publication 504 – “Divorced or Separated Individuals” – provides that divorced parties may agree on the division of joint estimated tax payments made during marriage.

Because the IRS credits the account of the spouse who’s SSN appears first on the estimated tax voucher (Form 1040ES) – almost always the husband’s – if the other spouse (assume W) claims any of the joint estimated tax payments on a separate return, W should indicate the ex-spouse’s SSN on page one of his or her IRS Form 1040 in the designated space. If W has remarried, she should enter the current spouse’s SSN in the appropriate space and enter the ex-spouse’s SSN, followed by “DIV,” on the line at the bottom of page one, where estimated tax payment credits are claimed.

Tax Refunds and Overpayments Applied to Next Year’s Tax

It is common practice to provide for the division of tax refunds resulting from the parties’ final joint income tax return.

But, in some cases, parties filing a joint return will apply all or a part of any tax overpayment to the following year’s tax rather than having it refunded. This frequently occurs when a return is on extension and filed after April 15 and the prior year overpayment is needed to cover current year tax to avoid the underpayment penalty.

The IRS has ruled that it will abide by an agreement of spouses who are no longer married regarding the apportionment of an overpayment of tax on a prior year’s joint income tax return that the parties elected to apply to the following year’s tax liability. Rev Rul 76-140.

However, here, too, because the IRS credits the account of the spouse who’s SSN appears first on the tax return, if the other spouse claims any of the applied overpayment, the other spouse should indicate the ex-spouse’s SSN on page one of his or her IRS Form 1040 in the designated space. If the other spouse has remarried, he or she should enter the current spouse’s SSN in the appropriate space and enter the exspouse’s SSN, followed by “DIV,” on the line at the bottom of page one, where estimated tax payment credits are claimed.

Practice Pointers

- Discover Tax Situation – As part of discovery, the tax overpayment or underpayment status of the parties should be determined. This can often be provided by the parties’ tax preparer.

- Over Withholding – The owner of a closely-held business can arrange excessive tax withholding. If undetected, the money that should be in marital accounts to divide will instead accrue 100% to the owner as a tax refund. The excessive withholding can be done on the last day of the year. So, the fact that withholding was not excessive on a September 30 pay stub is not a reliable safeguard against withholding manipulation.

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

Download the PDF file below… “Tax Return Filing Status and Related Matters”

View / Download February 2023 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)

Read More “Feb 2023 : Tax Return Filing Status and Related Matters”

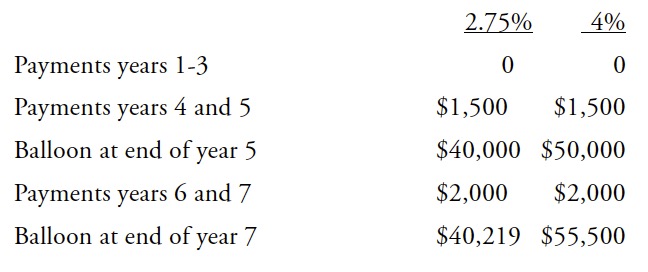

A prepayment provision with unstated, “baked in” interest would include a prepayment discount equal to the unstated rate of interest (2.75% in this case) applied to the outstanding balance at the time of prepayment over the period during which the balance was otherwise scheduled to be paid.

A prepayment provision with unstated, “baked in” interest would include a prepayment discount equal to the unstated rate of interest (2.75% in this case) applied to the outstanding balance at the time of prepayment over the period during which the balance was otherwise scheduled to be paid. As this shows, the difference between filing jointly and married filing separately is considerable, particularly at higher income levels. But, even at lower levels, the difference in the standard deduction is significant – a 100% higher joint vs. married filing separately.

As this shows, the difference between filing jointly and married filing separately is considerable, particularly at higher income levels. But, even at lower levels, the difference in the standard deduction is significant – a 100% higher joint vs. married filing separately. So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.

So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.