View / Download March 2023 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

The value of a closely held business or professional practice often dwarfs the value of other marital assets. If there are not sufficient suitable assets to award the non-owner spouse, installment payments are frequently used to balance the settlement.

In structuring the payments, two objectives often compete with one another:

- Don’t Kill the Golden Goose – It is important not to impose an undue strain on the owner’s cash flow, part of which may also be required for spousal and/or child support.

- Don’t Make Me Wait ‘Til I’m Old and Gray – On the other hand, it is generally not fair to require the non-owner spouse to wait a long period of time to receive his or her share of the marital value of the business.

Tailoring payments around other divorce obligations is a way to achieve both objectives.

Example

As part of their divorce settlement, H and W have agreed that he will pay her $200,000 for her one-half marital interest in his business. He will also pay combined transitional alimony and child support for their youngest child totaling $30,000 for each of the next 3 years.

H receives an annual salary of $60,000, supplemented by a bonus depending on company profit. He proposes that he pay the $200,000 by transferring a sufficient amount of his 401(k) plan to net W $50,000 after tax and that the $150,000 balance be paid over 15 years with interest at 4%, resulting in monthly payments of $1,110.

W responds that this is unacceptable; that it is unreasonable to expect her to wait so long for her share of the marital value of the business. She demands payment over 7 years, resulting in monthly payments of $2,050, almost twice what H proposed.

However, H claims he cannot afford to pay that much since the business has not been able to pay bonuses of late and the near future looks no brighter. In particular, he’ll be tight over the next few years with the alimony and child support obligations.

The attorneys meet with their joint CPA expert and work out the following payment terms to achieve both objectives.

No payments of principal and interest for three years. Adding the $18,000 of unpaid compound interest brings the principal to $169,655 as of the beginning of the fourth year.

- Years four and five – $1,500 per month

- At end of year five – $50,000 balloon payment

- Years six and seven – $2,000 per month

- At end of seven years – $55,500 balloon payment.

Tailored to Fit – The above indicates the way in which payments can be tailored to accomplish both objectives. The use of balloon payments enables the non-owner spouse to receive his or her share within a reasonable time frame. It also gives the owner spouse ample time to make arrangements to fund the balloon payments.

Related Matters

Provide for Acceleration – It is generally advisable to provide for acceleration of the balance due in the event the owner sells his interest in the business or the company receives a substantial influx of cash available to the owner, such as from refinancing.

Restrictions May Be in Order – In addition to normal security provisions, it is sometimes advisable to place restrictions on (1) the amount of compensation and/or distributions to the owner spouse and (2) the investment of business funds in non-operating assets (e.g., cabin up north or Florida condo “used for business”). Usually this can be done only if the owner spouse has a controlling interest.

Provide for Prepayment Option – Finally, it is often appropriate to provide for prepayment of the obligation at the option of the owner spouse.

Saving the Interest Deduction

The IRS has taken the position that interest paid on a divorce-related obligation from one ex-spouse to the other is “personal” interest and, hence, non-deductible. This results in a tax “whipsaw” since the payee ex-spouse receiving the interest must report it as taxable income notwithstanding that the payer cannot deduct it.

There have been a couple tax cases in which, under the circumstances of the case, the IRS position was rejected and the interest deduction was allowed as investment interest expense. However, the IRS has not acquiesced with these decisions and, further, investment interest expense can only be deducted to the extent of investment income (e.g., interest, dividends, etc.).

Aware of the IRS’s position, H’s CPA in the above example suggests that there is a way to avoid the loss of the interest deduction.

- This method is to “impute” interest at a rate approximating the after-tax equivalent of the agreed-on interest rate. The IRS and U.S. Tax Court have ruled that the imputed interest rules otherwise applicable to below market or no interest loans do not apply to divorce related obligations between ex-spouses. Under this approach, there is no loss of interest on the payee’s death.

So, H’s CPA proposes using 2.75% unstated, “baked in” interest rate as the approximate after-tax equivalent of 4.00%. This is done by running the amortization schedule with 2.75% as the interest rate to determine the payments. And, in the settlement agreement, the obligation to make the resulting payments is stated without reference to any interest rate.

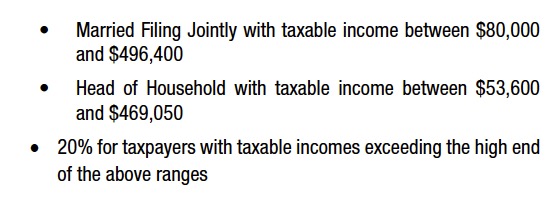

Substituting 2.75% for 4% on the $150,000 obligation results in the following changes – within the target seven year period:

A prepayment provision with unstated, “baked in” interest would include a prepayment discount equal to the unstated rate of interest (2.75% in this case) applied to the outstanding balance at the time of prepayment over the period during which the balance was otherwise scheduled to be paid.

A prepayment provision with unstated, “baked in” interest would include a prepayment discount equal to the unstated rate of interest (2.75% in this case) applied to the outstanding balance at the time of prepayment over the period during which the balance was otherwise scheduled to be paid.

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

View / Download March 2023 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)

Read More “Mar 2023 : Tailored Installment Payments to Balance the Scales without Breaking the Bank”

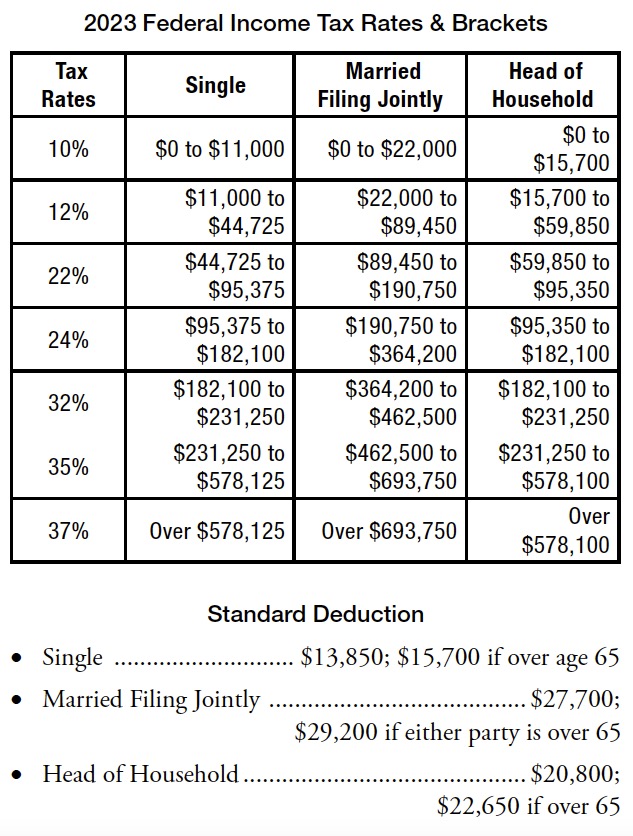

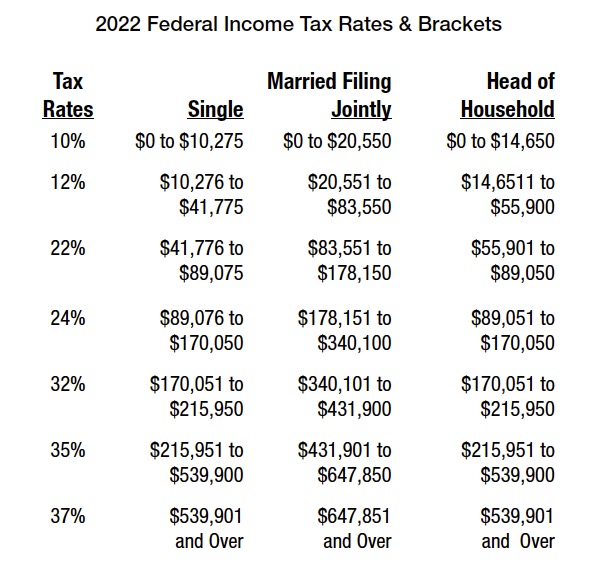

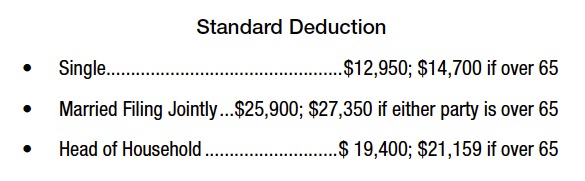

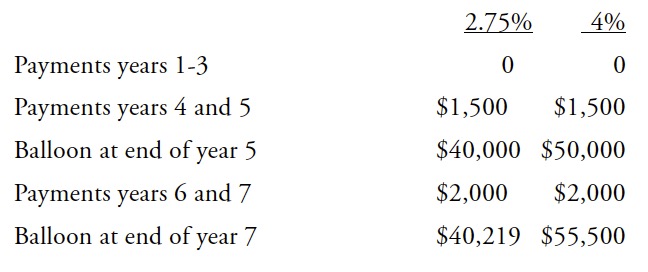

As this shows, the difference between filing jointly and married filing separately is considerable, particularly at higher income levels. But, even at lower levels, the difference in the standard deduction is significant – a 100% higher joint vs. married filing separately.

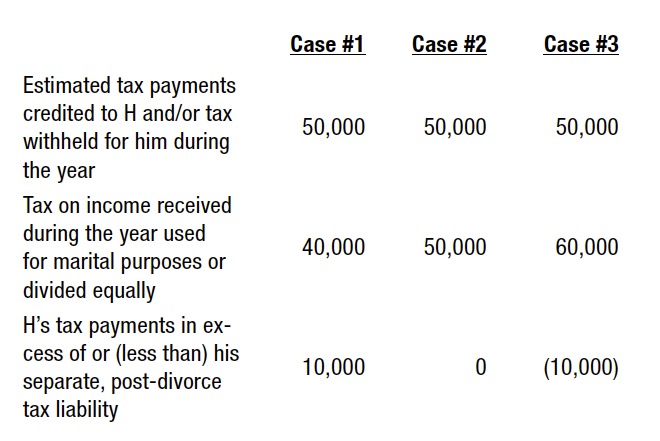

As this shows, the difference between filing jointly and married filing separately is considerable, particularly at higher income levels. But, even at lower levels, the difference in the standard deduction is significant – a 100% higher joint vs. married filing separately. So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.

So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.