View / Download December 2021 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

As the year-end approaches, there are various “below the radar” tax matters that can be relatively significant.

Filing Status for Year of Divorce

Whether divorcing parties can file a joint return or must file separate returns depends on their marital status as of December 31. If divorced as of that date, they must file separate returns for their respective separate incomes and deductions.

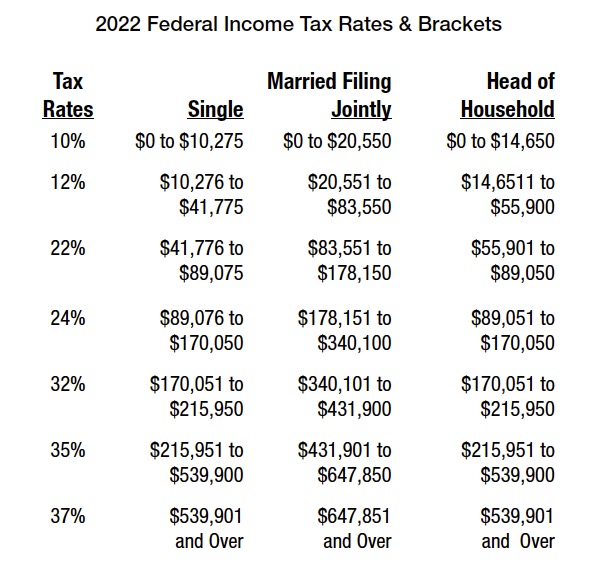

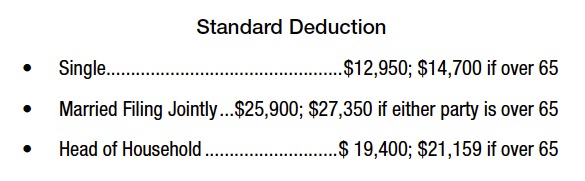

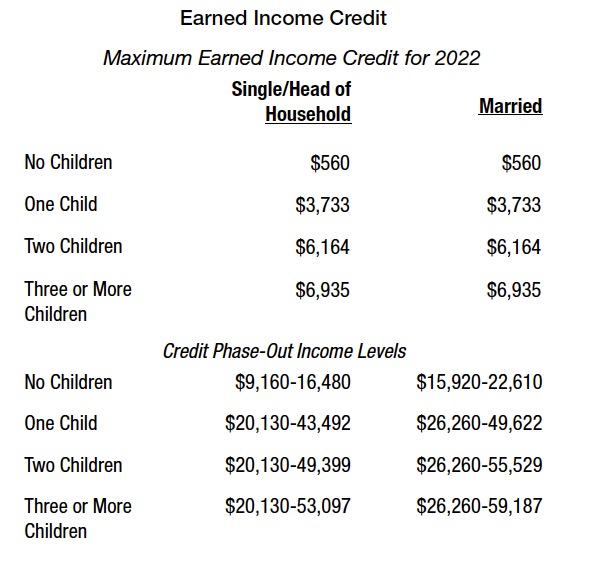

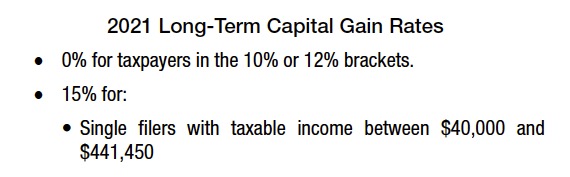

It is advisable to “run the numbers” both ways to know the filing option with less tax and, further, how much less tax.

If the lion’s share of income is attributable to one party, filing a final, joint return generally results in a lower overall tax liability. So, other considerations aside, the divorce should be deferred to after December 31.

But, there are instances where a spouse may not want to file a joint return for a good reason, such as questionable tax positions taken by the other spouse.

In this regard, a spouse generally cannot be compelled to file a joint tax return. In a 2014 published Court of Appeals case (Butler v. Simmons Butler, Mich App, No. 321445 11/18/14,) the Court ruled:

- In a situation where considerable tax would be saved by filing a joint return and one spouse will not agree to file jointly without good reason, the trial court could redistribute property to take into account the additional tax attributable to separate filing.

- However, if there is insufficient property to do so, “as a last resort”, the court could compel a spouse to file a joint return under the following circumstances:

- There is no history of tax problems with the other spouse;

- There is a history of the parties filing joint returns; and,

- The reluctant spouse is indemnified and held harmless by the other spouse.

Estimated Tax Payments and Tax Withheld During Marriage Are Marital Funds

Estimated tax payments made – and/or taxes withheld – during the year of divorce are generally made with marital funds and, hence, are a marital asset. Tax refunds or, overpayments applied to next year’s tax, attributable to tax payments made during marriage are similarly a marital asset.

Or, it may cut the other way – that is, estimated tax payments and/or taxes withheld may be less than the actual tax on marital income received and shared during the year of divorce.

Estimated Payments Automatically are Credited to the Husband

Since the husband’s social security number (SSN) is generally listed first on joint estimated payment vouchers (Form 1040ES) made during marriage, such payments will automatically be credited to him unless there is a written alternative provision agreed on by the parties.

The same applies to tax overpayments on the parties’ last joint return applied to the following year’s tax.

The above matters are often not addressed in divorce settlements.

The following presents (1) observations on such tax payments and (2) applicable tax law.

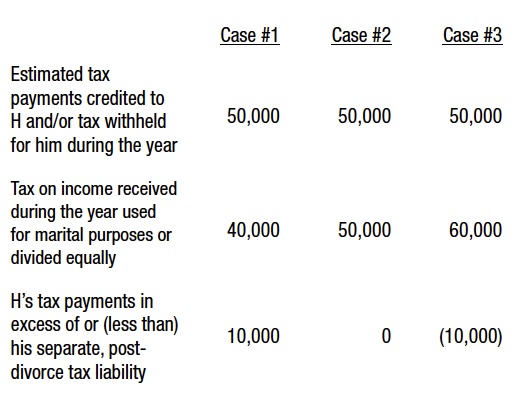

Tax Payments Made During the Year of Divorce

Example – Assume the following alternative facts for joint estimated tax payments made by – and/or withheld on behalf

of H – during the year of a divorce for which the judgment is entered on December 30.

So, in Case #1, H will receive a windfall unless W’s attorney identifies the overpayment and makes an offsetting adjustment. Half of H’s $10,000 overpayment was made with W’s share of marital funds.

In Case #3, it is H’s attorney who needs to (1) identify that H will pay $10,000 of his own funds on income equally shared with W and (2) make an offsetting adjustment. When paying the $10,000, H will, in effect, be paying both his and W’s $5,000 shares of the tax on marital income.

Agreement to Apportion Joint Estimated Tax Payments

IRS Publication 504 – “Divorced or Separated Individuals” – provides that divorced parties may agree on the division of joint estimated tax payments made during marriage.

Because the IRS credits the account of the spouse who’s SSN appears first on the estimated tax voucher (Form 1040ES) – almost always the husband’s – if the other spouse (assume W) claims any of the joint estimated tax payments on a separate return, W should indicate the ex-spouse’s SSN on page one of his or her IRS Form 1040 in the designated space. If W has remarried, she should enter the current spouse’s SSN in the appropriate space and enter the ex-spouse’s SSN, followed by “DIV” to the left of 1040, line 26.

Tax Refunds and Overpayments Applied to Next Year’s Tax

It is common practice to provide in the divorce settlement for division of refunds resulting from the parties’ final joint

income tax return.

But, in some cases, parties filing a joint return will apply all or a part of any tax overpayment to the following year’s tax rather than having it refunded. This frequently occurs when a return is on extension and filed after April 15 and the prior year overpayment is needed to cover current year tax to avoid the underpayment penalty.

The IRS has ruled that it will abide by an agreement of spouses who are no longer married regarding the apportionment of an overpayment of tax on a prior year’s joint income tax return that the parties elected to apply to the following year’s tax liability. Rev Rul 76-140.

However, here, too, because the IRS credits the account of the spouse who’s SSN appears first on the tax return, if the other spouse claims any of the applied overpayment, the other spouse should indicate the ex-spouse’s SSN on page one of his or her IRS Form 1040 in the designated space. If the other spouse has remarried, he or she should enter the current spouse’s SSN in the appropriate space and enter the ex-spouse’s SSN, followed by “DIV” to the left of 1040, line 26.

Practice Pointers

- Discover Tax Situation – As part of discovery, the tax overpayment or underpayment status of the parties should be determined. This can often be provided by the parties’ tax preparer.

- Over Withholding – The owner of a closely-held business can arrange excessive tax withholding. If undetected, the money that should be in marital accounts to divide will instead accrue 100% to the owner as a tax refund. The excessive withholding can be done on the last day of the year. So, the fact that withholding was not excessive on a September 30 pay stub is not a reliable safeguard against withholding manipulation. Rather, the owner’s W-2 should be reviewed for the relationship between (1) income and (2) income tax withheld to discover whether there is excessive withholding.

- Specific Divorce Settlement Provisions – In addition to discovering the parties’ “tax situation,” the settlement agreement should include express provisions regarding matters such as division of refunds, splitting joint estimated tax on separate returns, and ensuring an equitable sharing of tax on marital income for the year of divorce.

IRS Publication 504 – “Divorced or Separated Individuals”

This an excellent 30 page summary of divorce taxation. It covers the following topics:

- Filing Status

- Exemptions

- Alimony

- QDROs & IRAs

- Property Settlements

- Costs of Getting a Divorce

- Tax Withholding and Estimated Tax

Publication 504 was updated in February 2021 and has a two-page detailed index. It is available for download at http://www.irs.gov/pub/irs-pdf/p504.pdf

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

Download the PDF file below… “Year-End Tax Considerations – File Joint or Separate; Estimated Tax Payments; Tax Refunds/Overpayments”

View / Download December 2021 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)

Read More “Dec 2021 : Year-End Tax Considerations – File Joint or Separate; Estimated Tax Payments; Tax Refunds/Overpayments”