View / Download May 2020 Article – PDF File

Tax Trends and Developments Column – Michigan Family Law Journal

Similar to Michigan law, the Ohio Court of Appeals rejected the arbitrary limiting of owner spouse’s income in determining spousal support to avoid “double dipping.” Kim v. Kim, 2020-Ohio-22 (1/8/2020).

Background

So-called “double dipping” occurs if these four conditions are met:

- The business or professional practice (enterprise) owned by one spouse (owner spouse) is valued by capitalizing excess earnings (or cash flow).

- Part of such excess earnings results from reducing owner spouse’s actual compensation from the enterprise to a “market” – or, “normal” level, reasonable compensation.

- The capitalized value of the enterprise is included in the marital estate divided between the parties.

- The total amount of the owner spouse’s compensation is included in determining income available for spousal support.

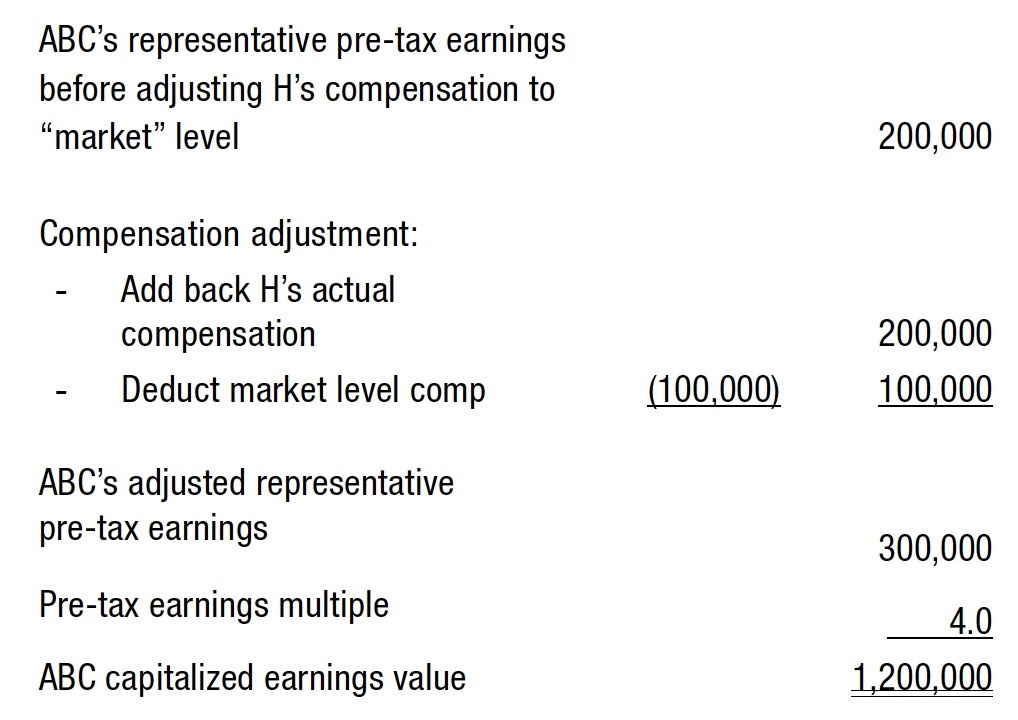

Example: H owns 100% of ABC Company (ABC). His average compensation from ABC is $200,000 annually. Reasonable compensation for his services, based on industry statistics, is $100,000.

If H’s actual compensation of $200,000 is used for determining spousal support, “double dipping” occurs since $100,000 of his actual compensation has been incorporated in the $1,200,000 value of ABC included in the marital estate divided between him and W. To avoid double dipping, H’s income for determining spousal support would be limited to $100,000.

Kim Case

Facts

- H owns and works at two businesses from which his average compensation is $520,000 annually.

- In calculating the value accepted by the trial court, H’s expert determined H’s “reasonable” or “market” compensation at $416,000.

- The trial court used H’s total compensation – $520,000 – in determining spousal support.

- It stated that, based on the circumstances of the case, equity does not require limiting H’s income for support purposes to avoid double dipping. In this regard, the court noted various factors indicating that H was in a much stronger financial position than W.

- H appealed the court’s decision.

Court of Appeals Decision

- The Court of Appeals (Court) upheld the trial court decision.

- In so ruling, the Court stated that it agreed with the analysis made in another Ohio case that the statute “precludes an outright prohibition of double dipping” and that the trial should, “in the interest of equity,” consider the effects of double dipping.

- In Kim, the Court noted that the trial court cited circumstances that were “overriding the unfairness of double dipping.”

Relevance to Michigan

Ohio, like Michigan, is an “equitable distribution” state. As we know, equitable distribution does not mean equal distribution to divorcing parties. Rather, trial courts have considerable discretion in tailoring a settlement to the equities of a case.

Double Dipping in Michigan – Loutts v. Loutts, Mich App No. 297427 (9/4/12)

- The Michigan Court of Appeals (COA) published decision in Loutts is consistent with the Ohio Kim decision and COA decisions in four previous Michigan unpublished decisions on “double dipping.”

- Essentially, the COA ruled that:

- The effect of “double dipping” can be taken into account in determining spousal support to achieve a proper balancing of incomes and needs.

- Hence, arbitrary limiting of the owner spouse’s income to avoid double dipping on a “bright line” basis is improper pursuant to MCL 552.23 and case precedents on using formulaic approaches to determining spousal support.

- However, if not needed to achieve a proper balancing of incomes and needs, double dipping should be avoided.

About the Author

Joe Cunningham has over 25 years of experience specializing in financial and tax aspects of divorce, including business valuation, valuing and dividing retirement benefits, and developing settlement proposals. He has lectured extensively for ICLE, the Family Law Section, and the MACPA. Joe is also the author of numerous journal articles and chapters in family law treatises. His office is in Troy, though his practice is statewide.

View / Download May 2020 Article – PDF File

Complete Michigan Family Law Journal available at: Michigan Bar website – Family Law Section (subscription required)